Debitum Is A Network For Token Sale

Debitum Is A Network For Token Sale

Small and medium-sized businesses have always been difficult to expand or expand their business because of the difficulty of credit requirements requested by the bank so that large companies or big players who always benefit because it has the resources of both human and large capital. this time I will discuss one of the Platform that will break this Industry.

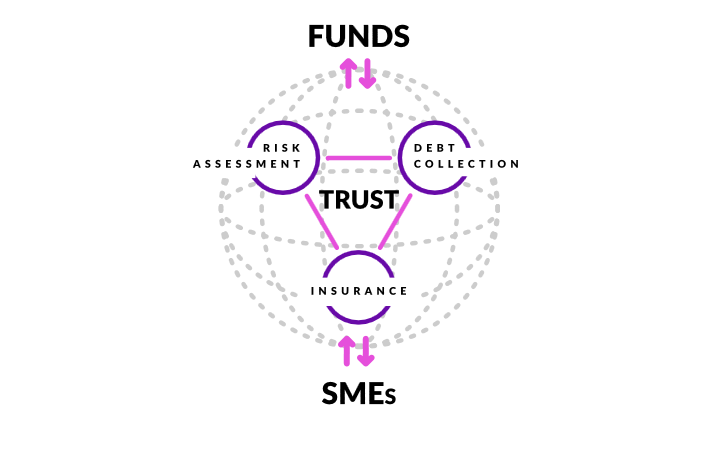

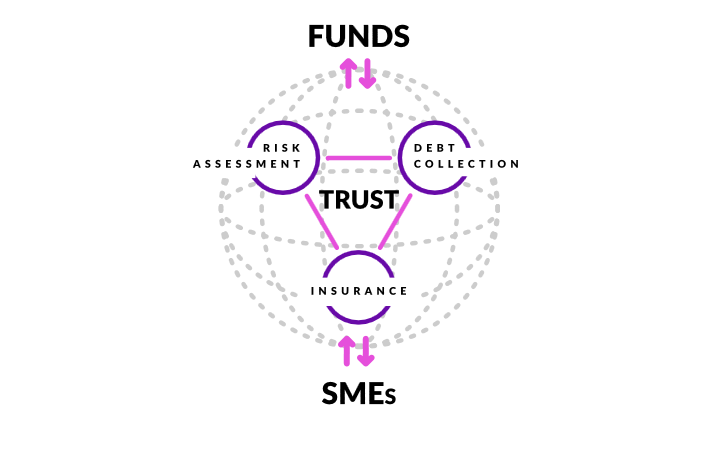

Lending money is all about trust and mechanical gears like collateral, measurable reputation, and fear of punishment. Born in an established society, we take the culture of business confidence that is just there; We rarely doubt the basics and address the quantitative measurement of business friction costs. However, to address the global credit gap - most of us must operate in young countries where business confidence is not granted.

By using a trust-based blockchain solution the Network Debitum ensures the trust required for all partners, especially investors, to operate within the ecosystem.

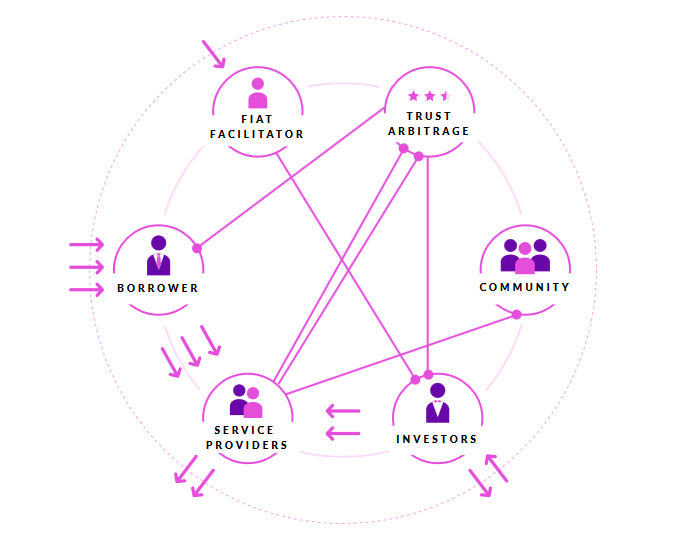

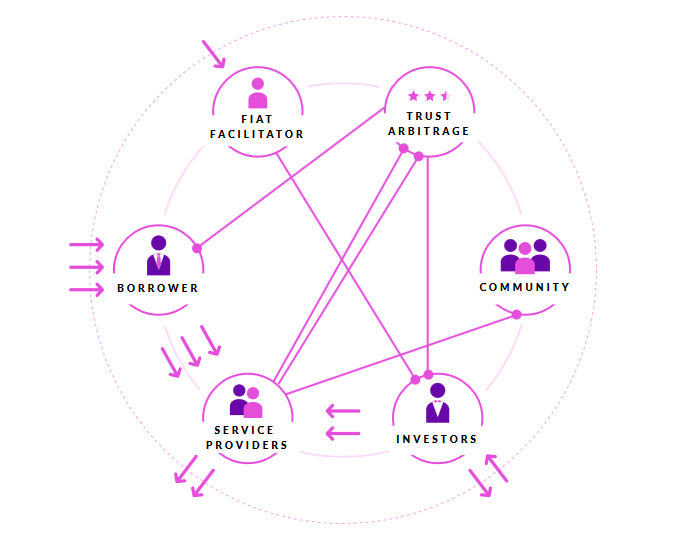

Debitum Network is an early market maker and facilitator to solve the worldwide credit gap by connecting SMEs with global investors who can rely on services provided by local or regional parties, ie, verification, risk assessment, insurance, debt collection.

At the global level, most of the current financing stages are done manually - meaning that they require human interaction that is usually supported by technology or some sort of IT solution. Currently there are fewer counterparties that have fully automated processes.

However, over time, it is believed that the financing process stages will become fully automated, for example using artificial intelligence solutions, machine learning algorithms and the like. To be ready for such a development, the Network Debitum will provide a public API (protocol) for all types of smart contracts in the ecosystem. Therefore the Debitum Network will be built to support current workings as well as future automation - artificial intelligence solutions will be able to use intelligent contracting APIs and integrate their actions with the Network Debitum.

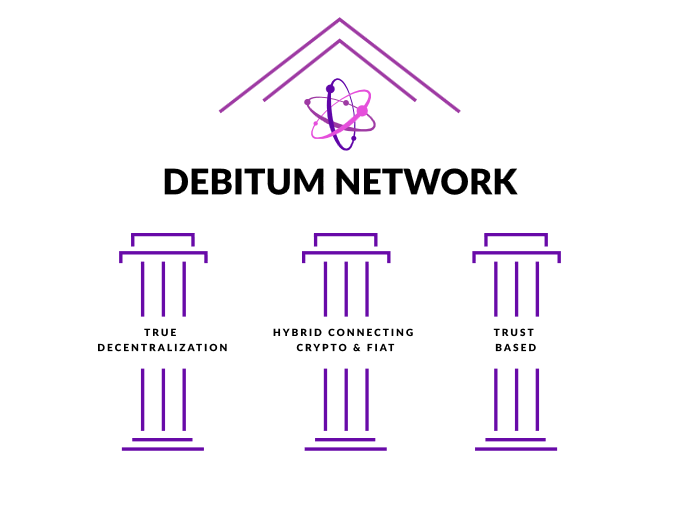

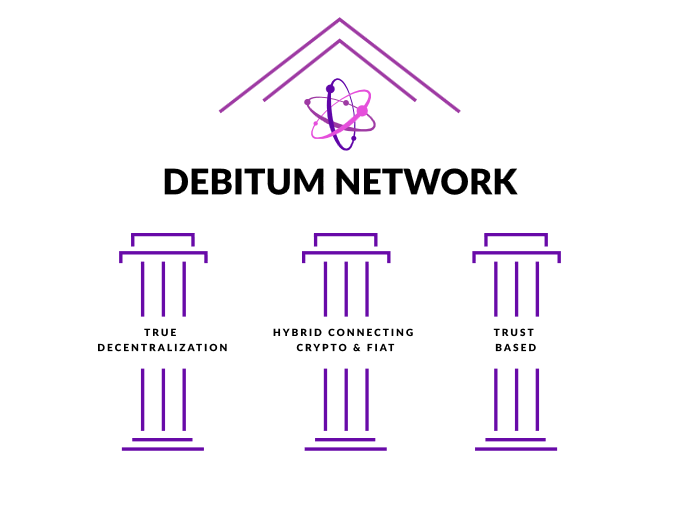

The three main pillars of the Debitum ecosystem

The Debitum Network is based on three important pillars that ensure uniqueness, disruption and will also ensure positive results on smalling credit loopholes:

There are 154 countries represented by the World Bank where SMEs experience credit gaps and where solutions such as the Debitum Network can help close the gap by providing partner ecosystems and linking them with global investors. However, by saying that the new Debitum Network team will be established in 154 countries and bringing ecosystems into their own markets will be a mistake.

There are 154 countries represented by the World Bank where SMEs experience credit gaps and where solutions such as the Debitum Network can help close the gap by providing partner ecosystems and linking them with global investors. However, by saying that the new Debitum Network team will be established in 154 countries and bringing ecosystems into their own markets will be a mistake.

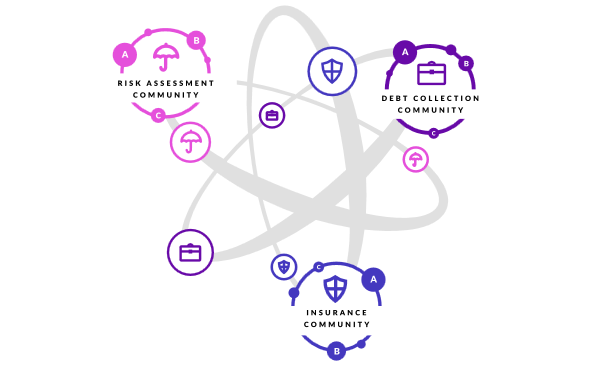

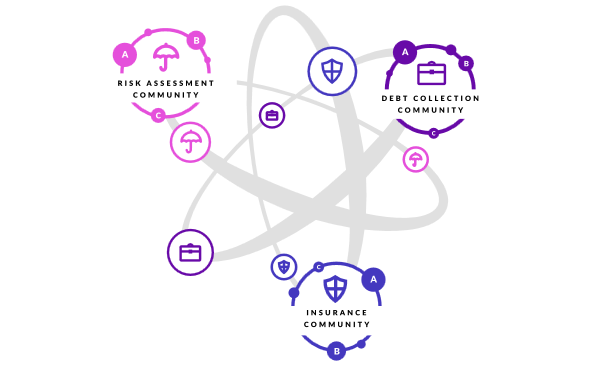

Anyone (one or more companies, one individual or more) who wish to start a community for service provision within the Network Debitum, must implement the interface / API of the Debitum Network community contract. Additionally, in this smart contract, community leaders must provide a rating calculation algorithm for community members and provide it for audits by the Debitum Network Trust Arbitrage to ensure that rating assessments conform to local and objective specifications and are consistent with all other valuation calculations.

It is possible to attract global investors to distribute their available capital and attract SMEs to borrow and finance their growth.

Token Sale Debitum (DEB)

400 million Debit tokens will be published

All existing Debitum tokens will be shared during this event.

Token name: Debitum (DEB)

Blockchain: Ethereal-based ERC223 token

Crowdsale: Stage 1 Crowdsale from 7 December Another token will be sold later according to the business development of the Debitum Network.

For Stage 1 Crowdsale the Hard cap is:

Round A: 4,000 ETH

Round B: 20,000 ETH

Price

Round A

Step 1

8,700 DEB for a total of 1 ETH

3,750 DEB for 1 ETH during Round A

An additional 4,950 DEB is given for 1 ETH after Round B

Round B

Step 2

7,800 for 1 ETH in total up to 500 ETH increases in the second round

Step 3

7,500 for 1 ETH in total after the second step up to 2,000 ETH increases in the second round

Step 4

7,150 to 1 ETH in total after the third step to 6000 ETH increases in the second round

Step 5

6,850 for 1 ETH in total after the fourth step to 14,000 ETH increases in the second round

Step 6 (main price)

6,500 for 1 ETH in total after the fifth step to 20,000 ETH increases in the second round

The goal is to create a fast-growing, trustworthy, self-sustaining, and global financing business ecosystem, the Debit Network, built around its members and using a single crypto-ecosystem - the Debitum token to pay for all services provided. Only those who have Debitum tokens can buy various services via the Debitum Network.

There are two intrinsic values for the existing Debitum sign:

'Exchange Value'

as the Debitum token is the only means of payment in the Debitum Network

'Toll'

as all service providers must 'freeze' a number of Debitum tokens to ensure the implementation of future services through the Trust Arbitrage mechanism

Based on the experience of most investors, especially the largest investors or institutions, are eager to survive in the ecosystem in the long run. Service providers see profitable business opportunities will also stay in the ecosystem for the long term. Borrowers are doubling: SMEs will survive in the short and medium term as it is expected to grow stronger and become 'bankable' and move on to cheaper financing options; while the organizational borrower (operator) must remain in the long run. Thus, we believe that as the Debitum Network grows, more and more members will join that need to use the Debitum token simultaneously, so we should see the demand increase at some point - increasing the token value. In addition, members of the wider Debitum Network ecosystem and community noticed an increase in the value of tokens may choose to hold onto tokens rather than sell them right after receiving through business transactions. Because this will make the supply shift down, the token value should continue to grow.

nowadays blockchain technology is still an alternative that is used to overcome gaps or gaps in various fields, but in the future blockchain will be one of the main models of problem solving in the world. and when that happens Debitum Network has become one of the established platforms with a great community.

Project contacts:

Telegram chat - https://t.me/debitum

Facebook - https://www.facebook.com/DebitumNetwork

Reddit - https://www.reddit.com/user/DebitumNetwork

Medium - https://medium.com/@mliberts

Twitter - https://twitter.com/DebitumNetwork

Author : the gaye ( https://bitcointalk.org/index.php?action=profile;u=1305050)

My address : 0x820410Ee0a97e9132aDDBb77c3f35bb3e5115d1e

Vidéo

Lending money is all about trust and mechanical gears like collateral, measurable reputation, and fear of punishment. Born in an established society, we take the culture of business confidence that is just there; We rarely doubt the basics and address the quantitative measurement of business friction costs. However, to address the global credit gap - most of us must operate in young countries where business confidence is not granted.

By using a trust-based blockchain solution the Network Debitum ensures the trust required for all partners, especially investors, to operate within the ecosystem.

Debitum Network is an early market maker and facilitator to solve the worldwide credit gap by connecting SMEs with global investors who can rely on services provided by local or regional parties, ie, verification, risk assessment, insurance, debt collection.

However, over time, it is believed that the financing process stages will become fully automated, for example using artificial intelligence solutions, machine learning algorithms and the like. To be ready for such a development, the Network Debitum will provide a public API (protocol) for all types of smart contracts in the ecosystem. Therefore the Debitum Network will be built to support current workings as well as future automation - artificial intelligence solutions will be able to use intelligent contracting APIs and integrate their actions with the Network Debitum.

The three main pillars of the Debitum ecosystem

The Debitum Network is based on three important pillars that ensure uniqueness, disruption and will also ensure positive results on smalling credit loopholes:

Anyone (one or more companies, one individual or more) who wish to start a community for service provision within the Network Debitum, must implement the interface / API of the Debitum Network community contract. Additionally, in this smart contract, community leaders must provide a rating calculation algorithm for community members and provide it for audits by the Debitum Network Trust Arbitrage to ensure that rating assessments conform to local and objective specifications and are consistent with all other valuation calculations.

It is possible to attract global investors to distribute their available capital and attract SMEs to borrow and finance their growth.

400 million Debit tokens will be published

All existing Debitum tokens will be shared during this event.

Token name: Debitum (DEB)

Blockchain: Ethereal-based ERC223 token

Crowdsale: Stage 1 Crowdsale from 7 December Another token will be sold later according to the business development of the Debitum Network.

For Stage 1 Crowdsale the Hard cap is:

Round A: 4,000 ETH

Round B: 20,000 ETH

Price

Round A

Step 1

8,700 DEB for a total of 1 ETH

3,750 DEB for 1 ETH during Round A

An additional 4,950 DEB is given for 1 ETH after Round B

Round B

Step 2

7,800 for 1 ETH in total up to 500 ETH increases in the second round

Step 3

7,500 for 1 ETH in total after the second step up to 2,000 ETH increases in the second round

Step 4

7,150 to 1 ETH in total after the third step to 6000 ETH increases in the second round

Step 5

6,850 for 1 ETH in total after the fourth step to 14,000 ETH increases in the second round

Step 6 (main price)

6,500 for 1 ETH in total after the fifth step to 20,000 ETH increases in the second round

The goal is to create a fast-growing, trustworthy, self-sustaining, and global financing business ecosystem, the Debit Network, built around its members and using a single crypto-ecosystem - the Debitum token to pay for all services provided. Only those who have Debitum tokens can buy various services via the Debitum Network.

There are two intrinsic values for the existing Debitum sign:

'Exchange Value'

as the Debitum token is the only means of payment in the Debitum Network

'Toll'

as all service providers must 'freeze' a number of Debitum tokens to ensure the implementation of future services through the Trust Arbitrage mechanism

nowadays blockchain technology is still an alternative that is used to overcome gaps or gaps in various fields, but in the future blockchain will be one of the main models of problem solving in the world. and when that happens Debitum Network has become one of the established platforms with a great community.

Project contacts:

Telegram chat - https://t.me/debitum

Facebook - https://www.facebook.com/DebitumNetwork

Reddit - https://www.reddit.com/user/DebitumNetwork

Medium - https://medium.com/@mliberts

Twitter - https://twitter.com/DebitumNetwork

Author : the gaye ( https://bitcointalk.org/index.php?action=profile;u=1305050)

My address : 0x820410Ee0a97e9132aDDBb77c3f35bb3e5115d1e

Komentar

Posting Komentar